How’s the Novato real estate market? This is a question we’re getting asked a lot more these days, as headlines shout about rising interest rates, rising inflation and stock market volatility. Watch this video from Erin McGinnis with Team McGinnis Realtors at Compass to learn more.

It’s true there are a lot of factors impacting the Novato real estate market right now, and people want to know: is this going to be a repeat of the crash we saw in 2008?

The answer to that is no, this is not like the housing market crash of 2008. The root cause of the 2008 crash was millions of households that got into home loans they could never afford, forcing a tsunami of distressed sales and bank foreclosures during the Great Recession. The chief market analyst with Compass reminded us last week that that environment simply does not apply today.

In Today’s Market:

-

Homeowners are paying their mortgages: Loan delinquency rates are close to all time lows.

-

Mortgage payments as a percentage of income are also near all time lows.

-

What’s more, most homeowners’ mortgages are locked in at historically low interest rates.

-

There has been no surge of desperate sellers.

-

And the stock market declines, though significant, do not even compare to those seen in 2008-2009.

-

And finally, employment remains very strong.

We are undoubtedly in the midst of a market correction, not a crash. Economists compare it to an over-pressurized tire with a slow leak versus a blow out on the highway at high speed.

When looking at market changes, it’s important to remember how overheated the market was in 2021 and early 2022. So when you hear comparisons of prices today versus 6 and 12 months ago, the drop in sale prices is going to sound very dramatic. But it’s almost a distortion because those higher prices were from a very unusual market supercharged by the pandemic and people’s behavior around housing.

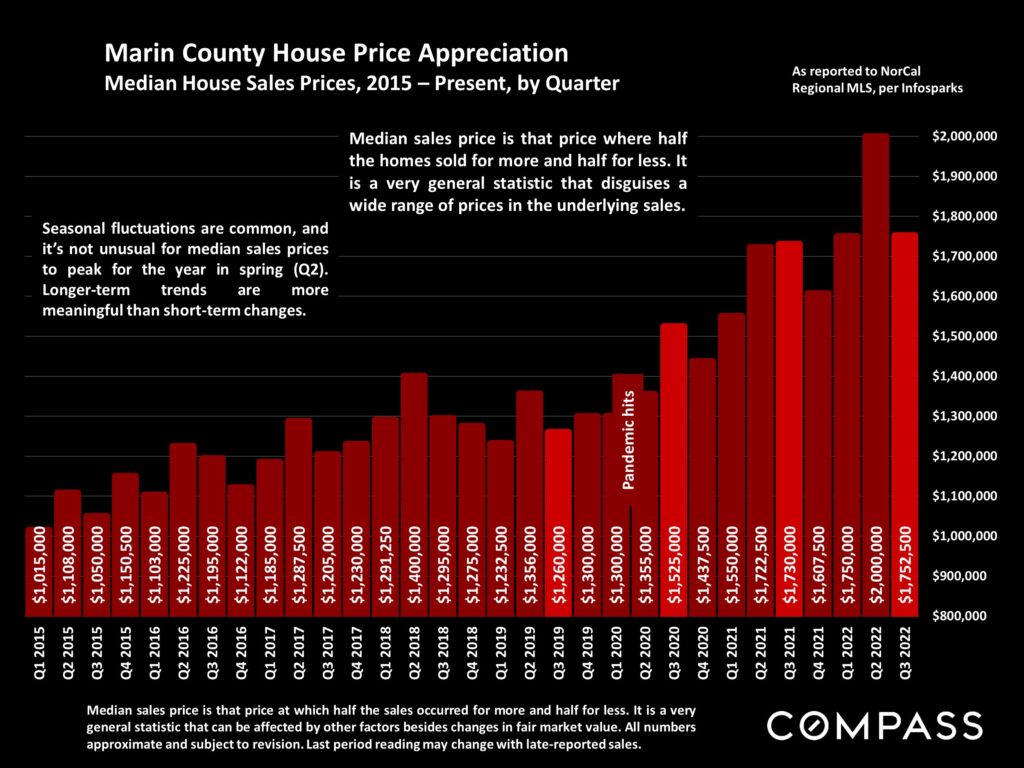

In this graph pay attention to the orange bars. This is Marin County home price appreciation from 2015 until now. Pre-pandemic prices are on a steady upward trend, but then you see where they spike – that’s an overheated market that is not sustainable. And that’s where we’ve been for the past 2-plus years.

Returning To Normal

Shifting back to a more normal market, as we are now, is a rocky period because buyers and sellers have to adjust their expectations. But every day we are helping our clients through this. We put 2 homes into escrow last week after just 7 days on the market. So there are positive things happening out there. We have weathered much more difficult markets than this, so if you’re thinking of selling or buying, please call us today.